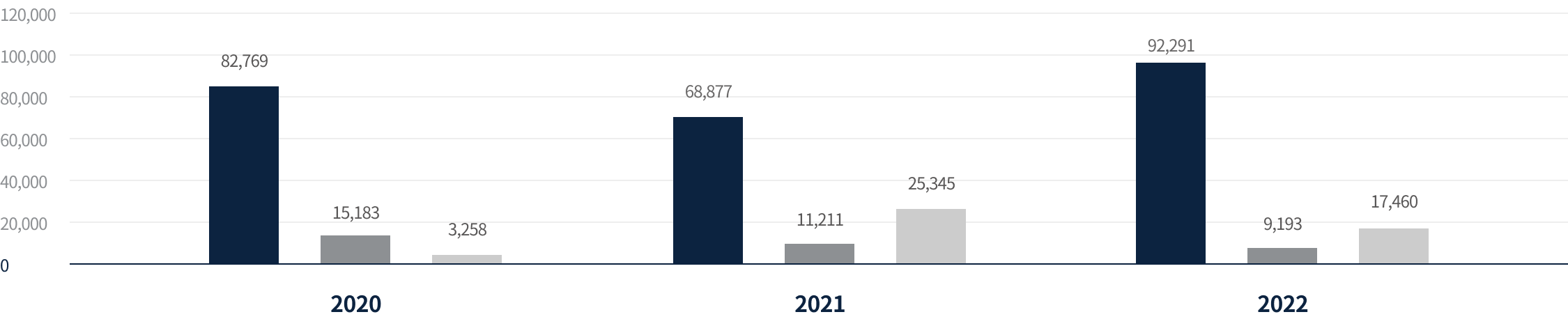

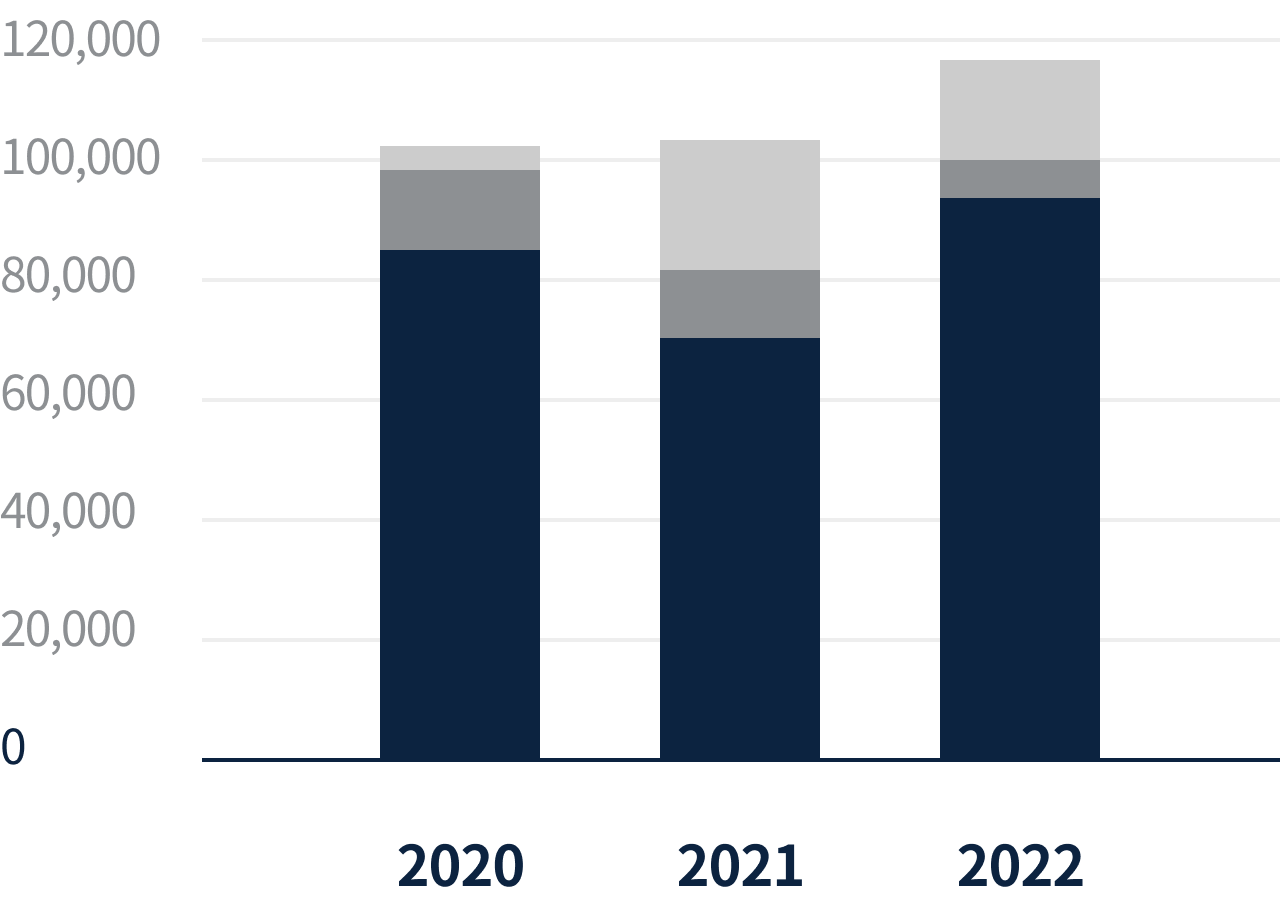

New Orders

Housing

Civil Engineering

Plant

※ K-IFRS Consolidated Basis

| Year | Total | Housing | Civil | Plant |

|---|---|---|---|---|

| 2022 | 118,944 | 92,291 | 9,193 | 17,460 |

| 2021 | 105,433 | 68,877 | 11,211 | 25,345 |

| 2020 | 101,210 | 82,769 | 15,183 | 3,258 |

Units : KRW 100 Million

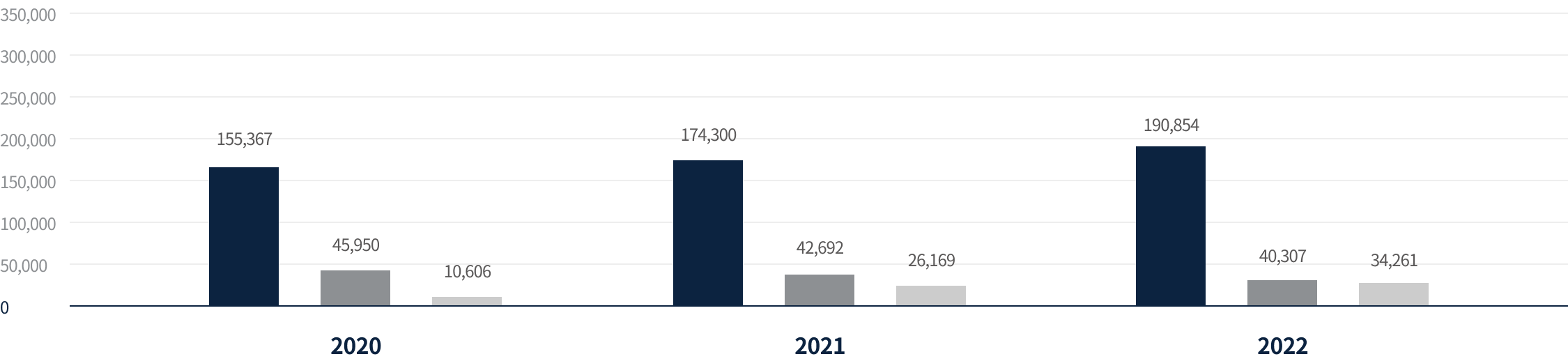

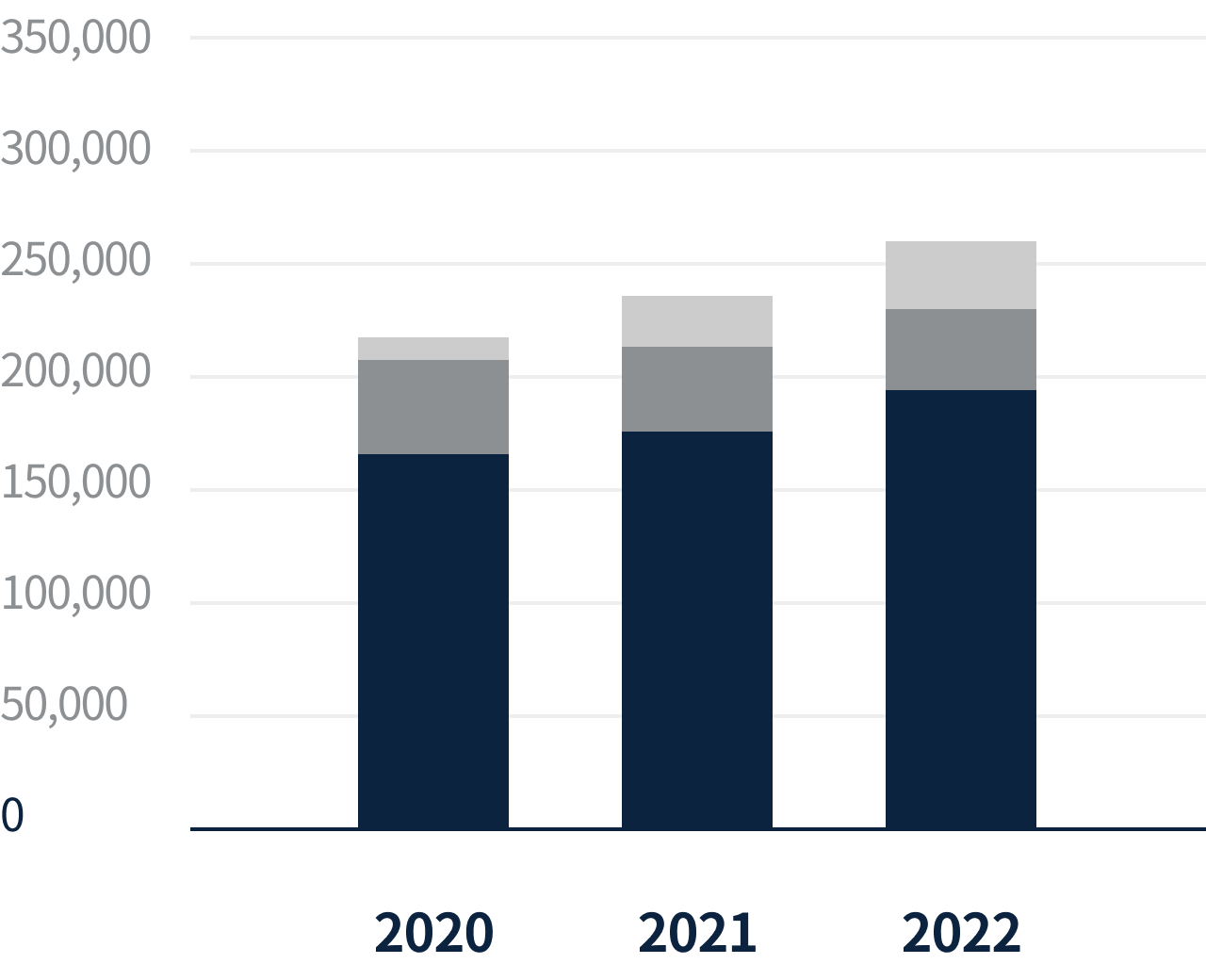

Backlogs

Housing

Civil Engineering

Plant

※ K-IFRS Consolidated Basis

| Year | Total | Housing | Civil | Plant |

|---|---|---|---|---|

| 2022 | 265,422 | 190,854 | 40,307 | 34,261 |

| 2021 | 243,161 | 174,300 | 42,692 | 26,169 |

| 2020 | 211,923 | 155,367 | 45,950 | 10,606 |

Units : KRW 100 Million

Sales

※ Adopted IFRS(Consolidated)

| Year | Total | Housing | Civil | Plant | Consolidated adjustments, etc. |

|---|---|---|---|---|---|

| 2022 | 74,968 100.0% | 52,948 70.6% | 13,372 17.8% | 8,831 11.8% | -183 -0.2% |

| 2021 | 76,317 100.0% | 50,774 66.5% | 15,043 19.7% | 10,582 13.9% | -82 -0.1% |

Units : KRW 100 Million

Profit

※ Adopted IFRS(Consolidated)

| Year | Gross Profit | Operating Profit | Earnings before Tax | Net Income |

|---|---|---|---|---|

| 2022 | 9,313 | 4,970 | 5,955 | 4,316 |

| 2021 | 13,864 | 9,573 | 9,093 | 6,358 |

Units : KRW 100 Million

Dividend

※ Source: Business report / Dividend payout ratio: consolidated basis

| Business Year | Total Dividend | Dividend Type | Dividend Per Share | Dividend Payout Ratio | Dividend Yield | Difference Dividend |

|---|---|---|---|---|---|---|

| 2022 | KRW 42,282,416,750 | Cash Dividend |

Common Shares: KRW 1,000 Preferred Shares: KRW 1,050 Preferred Shares (2PC): KRW 1,000 |

10.23 % |

Common Shares: 2.7% Preferred Shares: 4.3% Preferred Shares (2PC): 3.7% |

not applicable |

| 2021 | KRW 58,012,054,750 | Cash Dividend |

Common Shares: KRW 2,700 Preferred Shares: KRW 2,750 |

10.05 % |

Common Shares: 2.2% Preferred Shares:3.9% |

not applicable |

Credit Rating

Based on 2022 rating

| Rating Agency | Corporate Bonds | Commercial Paper |

|---|---|---|

| Korea Ratings Corporation |

AA- |

A1 |

| NICE Inverstors Service | ||

| Korea Inverstors Service |

| Type | Corporate Bonds | Commercial Paper | |||||

|---|---|---|---|---|---|---|---|

| Rating Agency | Korea Ratings Corporation | NICE Inverstors Service | Korea Investors Service Inc. | Korea Ratings Corporation | NICE Inverstors Service | Korea Inverstors Service | |

| Credit Rating | 2022 | AA- | AA- | AA- | A1 | A1 | A1 |

| 2021 | AA- | AA- | AA- | A1 | A1 | A1 | |